What is an Invoice?

Invoice. Business is all about providing goods and services. And the most fundamental of any business that requires payment for goods and services is an invoice.

An invoice is a formal document issued by a seller to a buyer, detailing the products or services provided, their quantities, prices, and the total amount due for payment. Invoices are crucial in business transactions as they serve as a record of sales, help track payments, and ensure compliance with tax regulations.

Key Components of an Invoice

Invoices have been an essential part of commerce and trade for centuries, with records dating back to ancient Mesopotamia, where merchants used clay tablets to document transactions. Over time, as economies evolved and businesses expanded globally, invoicing methods have undergone significant transformation. Today, with the advent of digital technology and regulatory requirements, invoices have become more standardized and sophisticated, serving not just as a request for payment but also as a crucial financial document for tax compliance and record-keeping.

Understanding the key components of an invoice is essential for accurate financial documentation and seamless transactions. A well-structured invoice ensures clarity, reduces disputes, and facilitates timely payments. It also helps businesses maintain professionalism, comply with legal requirements, and avoid potential financial discrepancies.

‣ Header: The word “Invoice” clearly displayed.

‣ Invoice Number: A unique identifier for tracking purposes.

‣ Date of Issue: The date the invoice is generated.

‣ Seller’s Information: Business name, address, contact details, and tax identification number.

‣ Buyer’s Information: Name, address, and contact details of the recipient.

‣ Description of Goods/Services: Detailed breakdown of items sold or services provided.

‣ Quantity & Unit Price: Number of units and price per unit.

‣ Total Amount: Sum of all items before tax.

‣ Taxes and Discounts: Applicable taxes (e.g., VAT, GST) and any discounts.

‣ Payment Terms: Due date, accepted payment methods, and late payment penalties.

‣ Bank Details: For electronic payments.

‣ Terms and Conditions: Additional information such as return policies or disclaimers.

Types of Invoices

In the modern business landscape, there are several types of invoices designed to meet different transactional needs. From traditional paper invoices to digital formats such as e-invoices, businesses now have multiple options to streamline their billing processes. The most commonly used invoice types include pro forma invoices, commercial invoices, credit invoices, debit invoices, recurring invoices, and tax invoices, among others. Each type serves a specific purpose, ensuring clarity in financial dealings and improving cash flow management.

Understanding these various invoice types is essential for businesses to optimize their billing processes, maintain compliance, and foster transparent relationships with clients and vendors.

‣ Proforma Invoice: A preliminary bill sent before the final sale to provide an estimate, commonly used in international trade and project-based work.

‣ Sales Invoice: Issued after a sale to request payment from customers, widely used in retail and wholesale transactions.

‣ Recurring Invoice: Used for ongoing services such as subscriptions in industries like SaaS and utilities.

‣ Credit Invoice (Credit Memo): Issued for refunds or discounts, typically in e-commerce and retail sectors.

‣ Debit Invoice: Issued to increase the amount owed by the buyer, often used in corrections or additional charges.

‣ Commercial Invoice: Used for international trade, including customs details, required for cross-border shipments.

‣ Timesheet Invoice: Used for billing hours worked, common in service-based businesses like consulting and freelancing.

Invoice vs. Estimate vs. Quotation

In the world of business transactions, the terms invoice, estimate, and quotation are often used interchangeably, but they serve distinct purposes. Understanding the differences between them is crucial for effective financial management and customer communication.

The concept of estimates and quotations dates back to the early days of commerce, when merchants and tradespeople needed a way to provide potential buyers with an idea of costs before finalizing a deal. Estimates have historically been used as rough cost approximations, allowing flexibility based on market conditions or unforeseen factors. In contrast, quotations evolved as formal, binding documents that provide a fixed price for goods or services within a specific validity period.

Many businesses often confuse these three documents, but they serve different purposes:

‣ Estimate: A rough calculation of costs provided before work begins. It’s not legally binding.

‣ Quotation: A fixed price offer for goods or services, valid for a specific period. Once accepted, it becomes legally binding.

‣ Invoice: A formal request for payment after goods/services have been delivered.

Importance of Invoices in Business

Invoices play a crucial role in financial management, offering the following benefits:

‣ Professionalism – Reflects a business’s credibility and professionalism to clients and vendors.

‣ Financial Tracking – Helps in tracking revenue, outstanding payments, and overall financial health.

‣ Budgeting & Forecasting – Provides data for future financial planning and budgeting decisions.

‣ Client Relationships – Maintains transparency, fostering trust and better business relationships.

‣ Audit Readiness – Ensures all financial activities are documented for internal or external audits.

‣ Legal Evidence: Proof of transactions for both parties.

‣ Cash Flow Management: Helps businesses track payments and outstanding balances.

‣ Tax Compliance: Essential for auditing and tax reporting purposes.

‣ Dispute Resolution: Serves as documentation in case of conflicts.

‣ Legal Protection – Safeguards the business by outlining terms, conditions, and payment expectations.

Digital Invoice & Paper Invoice

What is a Paper Invoice?

A paper invoice is a physical document printed on paper that details the goods or services provided, their cost, and payment terms. Paper invoices are manually handled, stored in physical files, and often require postal delivery for communication between businesses and clients.

Paper invoices are said to be originated from ancient civilizations (e.g., Mesopotamians used clay tablets for recording transactions around 3000 BC). The modern printed invoice format became widely used with the rise of commerce in the 19th and 20th centuries.

What is a Digital Invoice?

A digital invoice is an electronic version of a traditional paper invoice that is created, sent, received, and stored using digital tools such as email, accounting software, or cloud-based platforms. Digital invoices can be in formats like PDF, XML, or electronic data interchange (EDI) files and often integrate with business systems to automate processing.

Digital Invoices emerged in the 1960s with the advent of EDI (Electronic Data Interchange), allowing businesses to exchange invoices electronically. The 1990s and early 2000s saw wider adoption with the rise of email and accounting software. Cloud-based invoicing gained popularity in the 2010s.

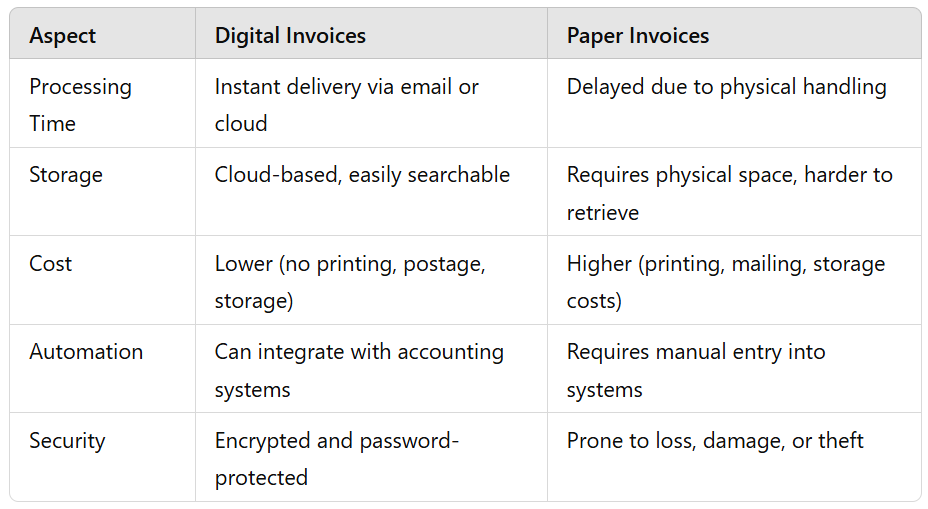

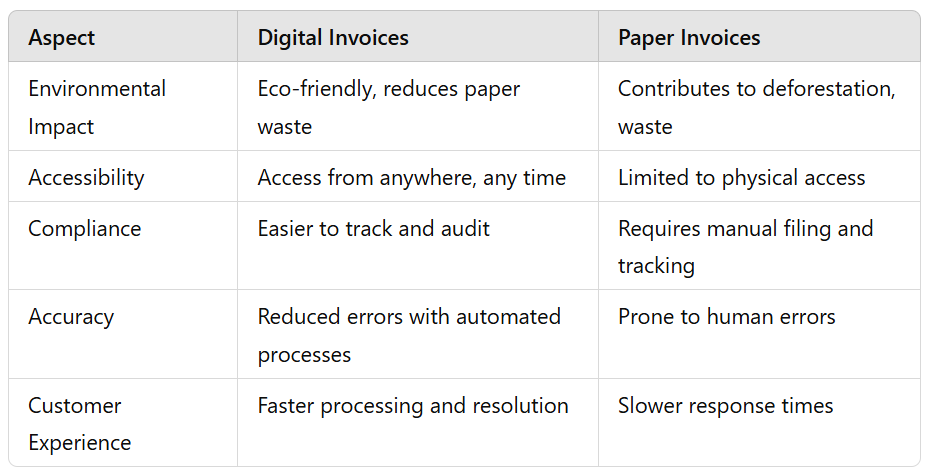

Digital Invoice vs. Paper Invoice

With the advancement of technology, digital invoices have become more popular due to their efficiency and eco-friendliness. However, some businesses still prefer paper invoices for legal or traditional purposes.

Understanding invoices and their various aspects is essential for smooth business operations. Whether you are a freelancer, small business owner, or a large corporation, proper invoicing ensures professionalism, compliance, and effective cash flow management.

By leveraging modern invoicing solutions, businesses can streamline their financial processes and focus on growth. Tools like the Envise Invoice app is one such digital invoicing system worth your time investment. Try exploring and see the change in your work flow.