The Invoice Playbook: 10 Types You Should Be Using

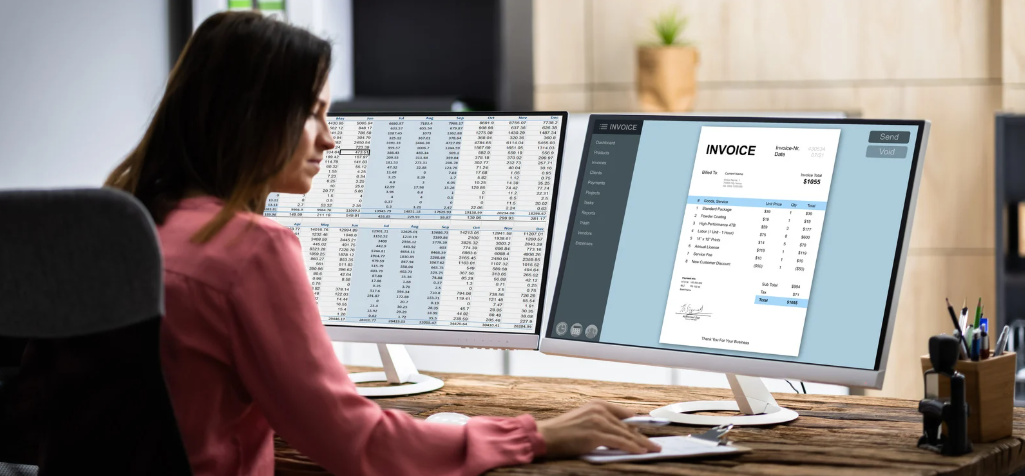

Whether you’re a freelancer, a growing startup, or an established enterprise, invoicing is a key part of getting paid and staying organized. But did you know there isn’t just one type of invoice?

From the first quote to the final payment—and everything in between—different types of invoices serve different purposes. And choosing the right one can help you look professional, stay tax-compliant, and keep your cash flow in check.

Let’s break them down together.

🧾 What is an Invoice, anyway?

An invoice is more than just a bill. It’s a formal document that outlines what a buyer owes a seller after receiving goods or services. It includes important details like:

• The product or service provided

• The cost

• Applicable taxes

• Payment terms

• Due date

Now, let’s dive into the different types of invoices and when to use them.

🔹 1. Standard Invoice – The Classic One

This is the most common type. It’s used when a customer owes you for a completed product or service.

👉 Best for: One-time purchases, completed services, or physical products.

📋 Includes: Description, price, tax, total amount, due date.

🔹 2. Proforma Invoice – The Preview

A proforma invoice isn’t a demand for payment—it’s more of a preview or quote. Think of it as a “heads up” to the customer.

👉 Best for: Sharing estimated costs before delivering the product/service.

💡 Tip: Helps in international trade and customs processes too.

🔹 3. Recurring Invoice – Set It and Forget It

If you bill a client regularly (like monthly software subscriptions), a recurring invoice is your best friend.

👉 Best for: Retainers, SaaS, maintenance contracts.

⚙️ Pro Tip: Automate it using invoicing software to save time!

🔹 4. Interim (Progress) Invoice – For Long Projects

Doing a project over weeks or months? Instead of waiting till the end, send interim invoices.

👉 Best for: Construction, marketing retainers, software development.

📆 Example: 25% upfront, 25% midway, 50% on delivery.

🔹 5. Final Invoice – The Wrap-Up

This is the last invoice in a series—sent after the job is complete and all previous payments are adjusted.

👉 Best for: Wrapping up phased or milestone-based projects.

🔹 6. Credit Invoice (Credit Note) – When You Owe Them

Mistake in pricing? Or maybe your customer returned a product? A credit invoice is issued when you owe your customer money.

👉 Best for: Refunds, returns, or post-sale discounts.

💸 It reflects a negative amount.

🔹 7. Debit Invoice (Debit Note) – When They Owe You More

If you undercharged or added a new service later, you issue a debit invoice to adjust the amount.

👉 Best for: Additional hours, extra features, or added costs after the initial invoice.

🔹 8. Timesheet Invoice – Time is Money

For freelancers and consultants, billing by the hour is common. A timesheet invoice shows exactly how much time was spent and on what tasks.

👉 Best for: Freelancers, agencies, support professionals.

🔹 9. Commercial Invoice – Crossing Borders?

This is used in international trade and is required for customs clearance. It includes the value, description, and country of origin of goods.

👉 Best for: Exporters and importers.

🔹 10. E-Invoice – Go Paperless, Stay Compliant

This is the invoice type that can support all above-mentioned types of invoices! Yes, because, this is a digitally generated invoice, often uploaded directly to government or business portals. Many countries (like India under GST) mandate e-invoicing for tax compliance. With the right software, you could have any types of invoice generated digitally, for your business.

👉 Best for: Businesses needing tax-compliant, automated systems.

Each type of invoice serves a specific purpose, and using the right one keeps your business transparent, professional, and financially healthy.

If you’re still creating your invoices manually, it might be time to explore smart invoicing software that handles all of the above—so you can focus on growing your business, not chasing payments.

💡 Need Help with Smarter Invoicing?

Envise could be your best choice!

Envise Invoice App simplifies billing with smart, customizable invoice templates and automated reminders—making it easier to get paid on time.

Perfect for freelancers, startups, and growing businesses looking to streamline their invoicing process.

Found this useful?

Share this with your team or network—it might just save someone an invoicing headache.

We, Ascent24 Technologies, build business-fit software solutions that simplify operations—including invoicing, billing, and accounting. Whether you’re a freelancer or a fast-growing company, our solutions are tailored to fit your business, not the other way around.