Invoicing in the Gig Economy: Challenges and Solutions

Gig workers are the new trend, all thanks to social media and the works that can be carried out online, from any part of the world.

In the ever-evolving landscape of the gig economy, where freelancers and independent contractors reign supreme, one crucial aspect often overlooked is invoicing. For these digital nomads, invoicing isn’t just about sending out bills; it’s about ensuring timely payments, managing multiple clients, and maintaining financial stability.

What are the challenges faced by freelancers in invoicing?

Challenges for Gig Economy

Client Dependence and Delayed Payments : One of the most significant challenges for gig workers is the reliance on clients for payments. Often, clients delay payments, disrupting freelancers’ cash flow and causing financial strain.

Managing Multiple Clients: Juggling multiple clients means dealing with different invoicing systems, payment terms, and currencies. This complexity can lead to errors, confusion, and ultimately, delayed payments.

Tracking Billable Hours and Expenses: Many freelancers charge clients based on billable hours or project milestones. Keeping track of these details manually can be cumbersome and prone to inaccuracies.

Maintaining Professionalism: Invoicing isn’t just about getting paid; it’s also about maintaining a professional image. Sloppy invoices or inconsistent branding can tarnish a freelancer’s reputation and hinder future business opportunities.

Tax Compliance: Freelancers must navigate complex tax regulations and ensure their invoices comply with local tax laws. Failing to do so can result in penalties and legal complications.

Payment Disputes: Resolving payment disputes can be time-consuming and emotionally taxing for freelancers. Clients may dispute invoices or delay payments due to dissatisfaction with the delivered work, contractual disagreements, or financial constraints.

Currency Conversion and International Transactions: Freelancers working with international clients often face challenges related to currency conversion rates, transaction fees, and cross-border payment regulations. These complexities can impact earnings and cash flow management.

Invoice Tracking and Follow-Up: Keeping track of sent invoices and following up on overdue payments can be a daunting task, especially when managing multiple clients simultaneously. Without efficient systems in place, freelancers risk missing out on payments or wasting valuable time on administrative tasks.

Client Communication and Feedback: Effective communication with clients is crucial for freelancers to understand project requirements, provide updates, and address feedback promptly. However, miscommunication or lack of clarity can lead to project delays, revisions, and ultimately, client dissatisfaction.

Data Security and Privacy Concerns: Freelancers, like corporates, handle sensitive client information and intellectual property, raising concerns about data security and privacy. Implementing robust cybersecurity measures and complying with data protection regulations are essential to safeguarding client trust and reputation.

Solutions

Invoicing is a critical aspect of freelancing in the gig economy, and overcoming its challenges is essential for financial success. And that’s where innovative software solutions step in, to make invoicing easier and professional. Choosing the right invoice software, is like choosing one of the winning card for any freelancer.

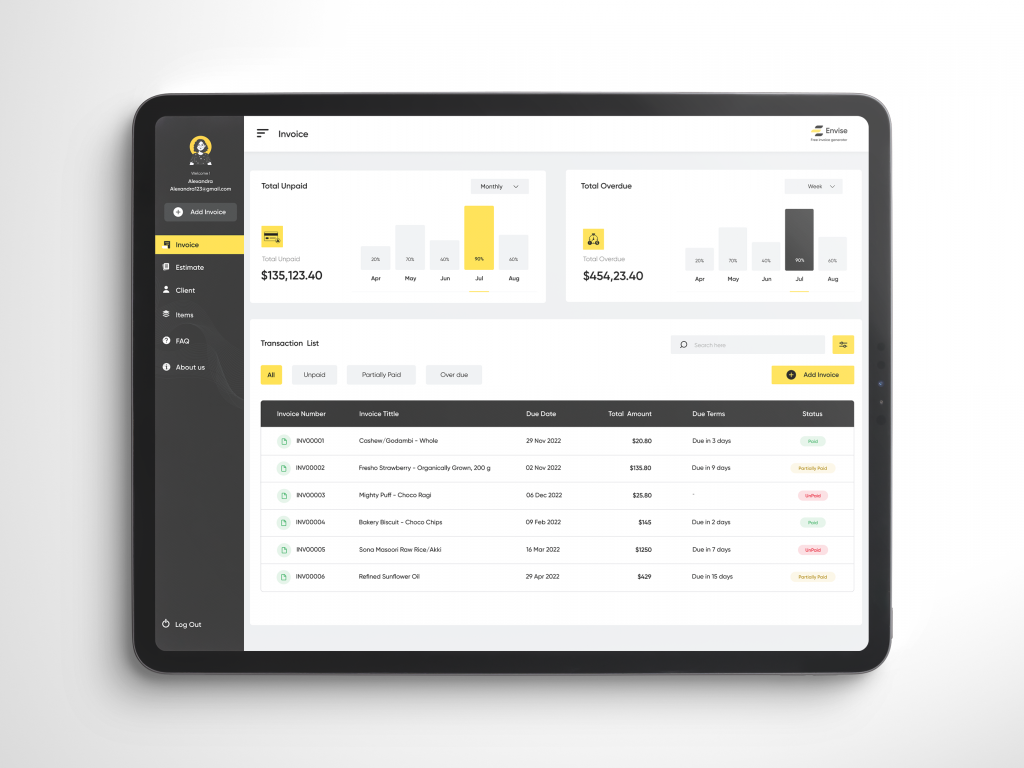

Streamline Invoicing Processes: These platforms automate invoicing tasks, allowing freelancers to generate professional invoices quickly and accurately. This efficiency saves time and ensures timely billing, improving cash flow management for gig workers.

Facilitate Payment Tracking: By providing features to track sent invoices, monitor payment statuses, and send reminders for overdue payments, these solutions empower freelancers to stay organized and assertive in managing their finances.

Enable Secure Online Payments: Many invoicing software solutions integrate payment gateways, enabling freelancers to accept online payments securely. This convenience not only expedites the payment process for clients but also reduces the risk of late or missing payments for freelancers.

Enable Secure Online Payments: Many invoicing software solutions integrate payment gateways, enabling freelancers to accept online payments securely. This convenience not only expedites the payment process for clients but also reduces the risk of late or missing payments for freelancers.

There are comprehensive invoicing and accounting solutions in the market, tailored for freelancers and small businesses, like Wave, Zoho Invoice, PayPal Invoicing, QuickBooks, FreshBooks, etc., to create professional invoices, track expenses, and accept online payments.

By leveraging innovative invoicing solutions, freelancers can streamline their invoicing process, ensure timely payments, and focus on what they do best – delivering exceptional work to their clients.

Envise, is one such growing free invoice generating app developed and is fast-growing among solopreneurs, SME owners, contractors, and freelancers. Try Envise

In this dynamic digital landscape, embracing technology is not just an option; it’s a necessity for thriving in the gig economy.

Leave a reply